Sustainable aviation fuel: navigating feedstock challenges & opportunities

By Paul Williams, PhD - Principal Consultant, Industrial, Chemicals & Energy

The aviation industry is at a critical point in its efforts to decarbonise, with sustainable aviation fuel (SAF) expected to contribute the bulk of the CO2 reductions. This alternative to petroleum-derived aviation fuel can be made from various feedstocks; it is blended with traditional jet fuel, which is then recertified. It’s important that petroleum companies, refiners, and fuel suppliers understand the SAF landscape, and the crucial role of feedstock, to aid strategic decision-making. The same applies to consumer goods companies with waste streams that might be used as SAF feedstock.

The SAF Landscape

The global aircraft fleet* is expected to double to over 46,500 by 2042 (Airbus Global Market Forecast 2023). That’s 40,000 new aircraft, each with a 30-35-year lifespan and all requiring JET A-1 grade-equivalent liquid fuel. The International Civil Aviation Organization’s (ICAO) prediction is even more extreme, suggesting aviation’s carbon footprint (which currently accounts for 2-3% of global CO2 emissions) potentially tripling by 2045 unless mitigation steps are taken.

*Passenger aircraft above 100 seats & freighters with a payload above 10t

Projected Growth of Global Aviation Emissions by 2045. Source: ICAO

Decarbonisation is a high priority for the sector, and advances in aircraft technology and operational improvements have a part to play. However, SAF is the most realistic approach to significantly reduce emissions.

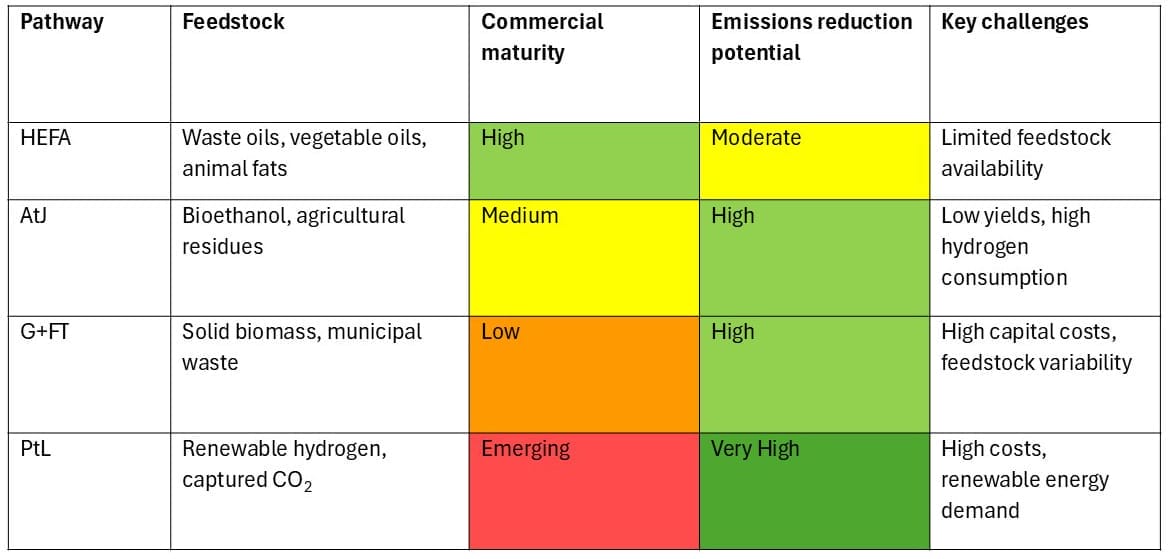

Currently, there are four main technology pathways for SAF production:

- Hydroprocessed Esters and Fatty Acids (HEFA): This is the most commercially mature approach, based on waste vegetable oils or animal fats.

- Alcohol-to-Jet (AtJ): Involves the conversion of bioethanol or other bio-alcohols.

- Gasification + Fischer-Tropsch Synthesis (G+FT): Uses solid biomass or municipal waste.

- Power-to-Liquids (PtL): This is an emerging technique, where fuel is synthesised from renewable hydrogen and captured CO2.

As the table below indicates, commercial maturity and emissions reduction potential vary across the four pathways. Feedstock is another key factor.

SAF feedstock considerations

Feedstock availability is paramount to SAF industry growth and long-term viability. HEFA, currently the dominant SAF pathway, faces significant constraints here. Limited availability of sustainable lipid feedstocks like used cooking oil (UCO) and tallow means HEFA will be insufficient to meet SAF targets beyond 2030. Europe imports significant amounts of UCO from China, and supply may be restricted when China introduces its own SAF mandate.

Advanced pathways like Alcohol-to-Jet and Gasification and Fischer-Tropsch offer a higher potential for emissions reduction than HEFA. They also utilise a wider range of feedstocks, including agricultural residues, energy crops**, and municipal solid waste. This diversity and scalability are crucial for the uptake of SAF production beyond what can be achieved with HEFA, but they come with their own technical and feedstock availability challenges. For instance, competition for resources demands careful consideration. Production of some SAF feedstocks may impact the availability of resources for other industries, including food production and other biofuel sectors. This competition impacts prices and availability, making strategic sourcing essential.

Ensuring transparency around feedstock sustainability is critical too. Issues such as land use changes, biodiversity impacts, and food security must be carefully managed to uphold SAF’s environmental credentials.

**Crops grown specifically to be converted into energy.

Implications of SAF for industry stakeholders

Opportunities, challenges, and priorities surrounding SAF differ across industry sectors.

Petroleum and refining companies have an opportunity to diversify product portfolios and align with decarbonisation trends. There’s great potential to leverage existing infrastructure and distribution networks. However, it will be necessary to invest in new processing capabilities and secure sustainable feedstock sources.

Fuel suppliers (including some of the refining companies mentioned above) face increased obligations as SAF mandates typically apply to them rather than airlines. However, existing production pathways could underpin the design of fuel-blending strategies that take advantage of growing market opportunities. Developing partnerships across the supply chain, from feedstock suppliers to airlines, will facilitate progress.

Food and beverage/consumer goods companies have an opportunity to create new revenue through the valorisation of waste streams as SAF feedstock. Contributing to aviation decarbonisation could also enhance sustainability credentials. However, steps would have to be taken to ensure feedstocks meet the quality and consistency standards of SAF production.

Market dynamics and regulatory landscape

Various policies and incentives are shaping the global SAF market. Noteworthy developments include:

- UK (UKGov): SAF mandate targeting 10% SAF blend by 2030 and 22% by 2040, with limits placed on HEFA to promote advanced pathways.

- European Union (EuropeanCommission): ReFuelEU initiative aiming for 2% SAF by 2025, 6% by 2030, and 70% by 2050.

- China (S&PGlobal): Expected to announce its SAF utilisation policy for 2030 this year, with a blending mandate of 2-5% anticipated.

- United States: SAF production is incentivised through tax credits based on lifecycle emissions reductions.

The EU and UK are forcing demand through mandates whilst providing an element of revenue certainty to stimulate investment in manufacturing capacity. China is set to do the same. The US is taking an incentivisation route to achieve the same goal.

Challenges and opportunities

Based on our analysis of the SAF market, there are seven principal areas of challenge and opportunity. Organisations that successfully navigate these matters stand to make effective inroads into this evolving industry:

- Cost: All production pathways currently result in fuel costs significantly higher than those of petroleum-based fuels. Diversifying the feedstock pool can help reduce this cost disparity, with less mature technologies such as Alcohol-to-Jet (AtJ), Gasification and Fischer-Tropsch (G&FT), and Power-to-Liquid (PtL) showing the greatest potential for cost reductions.

- Feedstock innovation: New feedstock sources and improved conversion efficiencies are critical for industry growth.

- Supply chain integration: There are opportunities to create integrated supply chains from waste generation to SAF production and distribution.

- Technology development: While HEFA is relatively mature (being based on established biodiesel technology), other pathways require development to increase their technology readiness level. The recent bankruptcy of Fulcrum Bioenergy, a leading waste to SAF manufacturer, primarily brought on by technical issues, highlights the perils of “first of a kind” development

- Technology investment: Emerging technologies like PtL could alleviate feedstock constraints but require significant investment in renewable energy and carbon capture.

- Sustainability certification: Developing robust certification systems for feedstocks and SAF production is essential for market credibility and access incentives.

- Strategic partnerships: Collaboration across industries will be key to overcoming feedstock limitations and scaling SAF production.

Conclusion

While SAF holds great potential for the decarbonisation of the aviation industry, feedstock availability and sustainability are of critical concern. Companies that can address these challenges – for instance via waste valorisation or fuel production innovation – have much to gain.

To leverage opportunities in this space, it’s important to understand the market dynamics and carve out a strategic position within the SAF value chain. Companies that get it right could play a crucial role in aviation’s sustainable future while unlocking new revenue streams and enhancing environmental credentials.

As the SAF industry evolves, staying informed on technological advancements, policy developments, and market trends will be essential to facilitate informed decision-making. Contact us to discuss how we can help your organisation capitalise on the growing SAF market.

References:

- https://assets.publishing.service.gov.uk/media/662938db3b0122a378a7e722/creating-the-UK-saf-mandate-consultation-response.pdf

- https://transport.ec.europa.eu/transport-modes/air/environment/refueleu-aviation_en

- https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/071024-bp-to-invest-4854-million-in-china-biofuels-producer-as-market-anticipates-saf-mandates-soon

- Climate Change (icao.int)